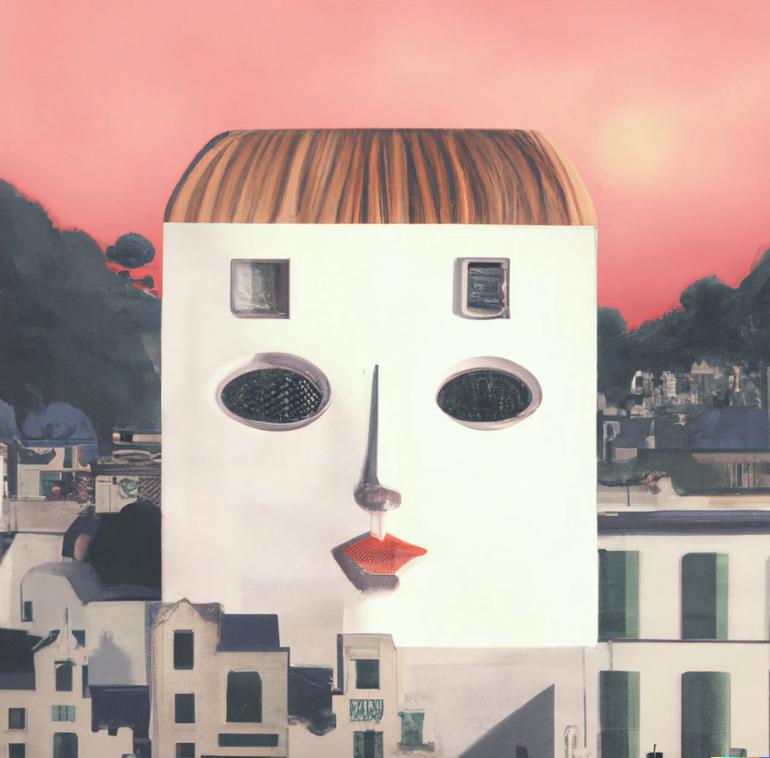

Startups: The Business Version of Professional Wrestling

Like professional wrestling, the startup ecosystem needs collective delusion.

Like professional wrestling, the startup ecosystem needs collective delusion. In the startup’s mind, the future is a battle between disruptors and stale incumbents. In truth, the future is a battle between market leaders and unproven, inexperienced competitors.

Startups thus rely on storytelling to sell themselves, much like professional wrestling relies on acrobatics, choreography and the occasional broken table to sell itself to its viewers. One of our favourite foresight experts, Venkatesh Rao, had a great piece on this kind of mythologizing recently — he calls it Lorecraft. Thanks to the startup’s lore, knowing that everything they are seeing is fake, both participants and the audience still pretend it’s all real.

In wrestling, we’re asked to believe that the animosity between wrestlers is real, that the violence and pain are authentic, and the outcomes have stakes. What delusions are we being asked to believe about startups?

Delusion 1: Success in a narrow niche will lead to success in a larger market

This is the most common lie startups tell. A new entrant to the market will never pick the hardest problem to solve: they’ll start with the easiest. Some examples:

15-minute grocery delivery — this model works well in densely populated cities with low labour costs vs gross margin, in regions like Asia and Latin America. When those same companies tried to operate in New York, LA, and Chicago, they failed.

Simple to sophisticated — In complex industries (like logistics and advanced manufacturing) or highly regulated ones (like financial services and health care), startups pick a niche that requires minimal knowledge or effort. We regularly see new telehealth providers, yet hospitals are incredibly profitable businesses. When was the last time someone started a new hospital?

The reality of startups is that many of them are just small businesses that are misguided about their limits.

We can all think of examples of startups that were successful in scaling way beyond their initial markets — but they’re the exceptions, not the rule. Incumbents are increasingly aware of this and so make scaling more difficult by buying companies early or finding ways to shut startups out of markets.

Delusion 2: Valuation, capital raised and investors are indicators of future success

In our work, we find our clients measuring startups’ threat to the established market based on how much money a company has raised or what it is valued at. But valuation is not a measure of success.

Investors are placing multiple bets; they are not tied to any individual success. Venture capital investors used to invest in 6–10 companies per fund. As the market has grown and scaled, they’re now investing in hundreds. For many funds, the goal is to invest in as many “credible” startups as possible. The investors understand that most of their investments will fail, and that just need one or two to be successful for the fund to be a success. You personally probably spend more time worrying about your in-laws than VC investors do worrying about their investments.

Valuation isn’t a measure of a company’s likelihood for success: it exists because there’s money to invest. In 2016, there were 165 startups valued at more than $1bn. By mid-2021, there were 743. We didn’t get a four-fold increase in five years because the companies have earned it. For the last year for which we have data, US VC funds raised over $51bn. They need to invest all that capital so, in addition to writing more cheques, they are writing bigger ones. Bigger cheques, bigger valuations.

There are many other lies we have been fed about the end of incumbents: that founders can change a market, that it’s ok to move fast and break things and that startups can do hard things. Market leaders have a clear advantage because they possess access to resources that can support consumers’ changing needs and market shifts - they just need to explore them.

Want to hear more about the lies of the startup world? Let us know and we can cover them in a future edition!

Quick Hits:

Listening rooms becoming interior must haves — Over the coming months, expect to see more and more articles addressing the ways in which housing has changed as a result of the pandemic. Part of that is people getting out of their homes and seeing the homes of others, and part is the lead time needed to make these changes. With rising real estate prices, these types of dedicated spaces will be the ultimate luxury. Expect specialty vacation rentals with chef’s kitchens or meditation studios to be highlighted as part of Airbnb’s refresh.

Time got weird — Everyone has a realization at some point in their lives that time is arbitrary and that hours and minutes are just a collective decision about how we delineate the day. While largely a humour piece, Paul Ford makes interesting points about how smartphone notifications and “push” technology (like email and WhatsApp) have changed how we control our schedules. As well, the idea that meetings and interactions must be shaped to fit calendar blocks (1hr/30mins) feels outdated, and the shift to more flexible structures can create interesting opportunities. If even Deloitte agrees, this is a real trend.

Startup Trail - With this issue’s topic, we had to include this link. Remember Oregon Trail? In this version, as opposed to saving our party from dysentery, you are trying to make sure your company does not run out of cash before it is acquired. Good luck!